A few years overseas has taught me one or two things about changing money and withdrawing it from foreign ATMs using an American debit card. I currently use Citibank because it is reliable and I am satisfied with it. They are also fine with me having a mailing address in New York City and being outside of the USA for an extended period of time, although some other banks are not.

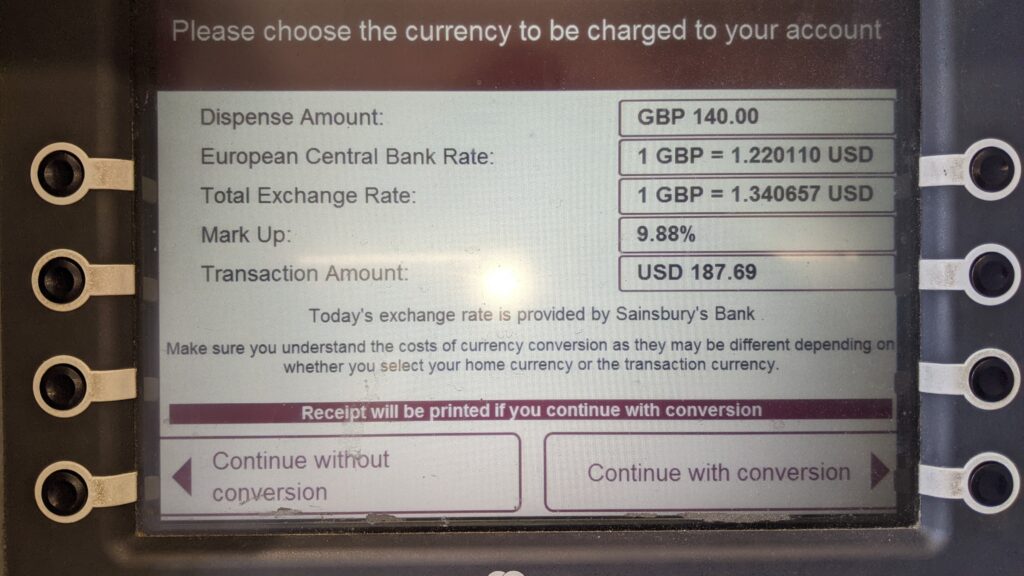

Tip #1: Continue WITHOUT Conversion. When withdrawing money from a foreign ATM make sure to click “Continue WITHOUT conversion” What this means is that you will receive the foreign exchange rate of your home bank and not the one shown on the screen, which is a usually a ridiculous 8 to 10% mark up. I cannot stress this enough. Most countries do allow banks to do this, but each country is different. Here in the UK, they offer a free atm fee, but some banks do charge for a foreign card withdrawal. Over in Spain you can find some banks that charge a fee and some do not. Here an example of my 140 British pounds withdrawn at a Sainsbury local ATM without any fee… Citibank charged me $176.60 for a withdrawal of 140 GBP, however Google is telling me $171.20. Citi is giving me a $1.26 to 1 exchange rate. Sometimes Citi charges me a rate closer to the official exchange rate listed on Google, it depends on the country and the currency withdrawn.

Tip #2. Shop around for the best rate. If you are bringing hard currency into a country, you will normally be able to find an exchange office to get bills changed. Make sure to shop around for the best rate. Just recently i was visiting the country of Morocco, one office listed the exchange rate as 10.2 MAD or Moroccan Dirham to 1 USD, whereas another listed it as 10.6 MAD. This is a 4% improvement over the first office.

Tip #3. Dispose or spend closed currencies and change before you leave a country. If you are a budget traveler like me, you mind each coin you spend, after all, as mentioned I’ve been traveling for a few years now. This is a site oriented towards budget minded travelers and backpackers. If you bring coins into a new country, normally you cannot get change for change, for example if i have 20 British 50 cent GBP coins, i wont be able to change these for the appropriate amount of Euros or USD or mad, and it just becomes a dead weight in my pocket when im in the new country. My solution to this is just to spend the coins at the airport on for example something you might use later like snacks or Kleenexes etc. When I left the USA somehow i ended up with $14 worth of coins inside my luggage. It was because i had just barely finished cleaning out my apartment when i boarded the plane. Over in Cambodia nobody would accept them, not even the USA embassy. Finally i found an American guy who was headed back to the States and he took them for me as a favor, but otherwise it would have been just a dead weight in my bags.

Tip #4. Get a fee Free ATM debit card. I personally choose not to follow this type of advice, but im going to soon look into getting an ATM card that doesn’t charge me the extra 3% that Citibank charges. I have stuck with them just because they are reliable and have never had an issue withdrawing money overseas. A few bank accounts and debit cards that i would personally like to research are these… Chase Premium Plus Checking, Betterment Bank, Capital One 360, online sign up only, Schwab High Yield Investor Account. I may very well go with two debit cards just to make sure that I have a backup account should something go wrong with my no fee account.

Tip #5. Have a backup transfer service like Western Union. One caveat, Western Union transfer fees are totally ridiculous, however the good news is that the service is really fast and reliable with outlets all over the world. Over in Morocco i had a friend send me $30. I stepped outside my hotel room and walked less than 1 block to pick it up, using my passport, but i think the total i got was $26. In an emergency this could come in handy if you run out of money. All I had to do was download the Western Union app on my cell phone enter my phone number and email and send my friend a request using her email. it worked great.